Strange and Surprising Facts About Money

Barter Origins

Early Exchange

Before coins or paper, ancient economies used direct bartering-goods for goods, such as grain for tools.

Limitations

Barter required both parties to want what the other offered, leading to inefficiencies.

Value Recognition

Items like salt, cattle, or shells gained value as common mediums of trade.Bills

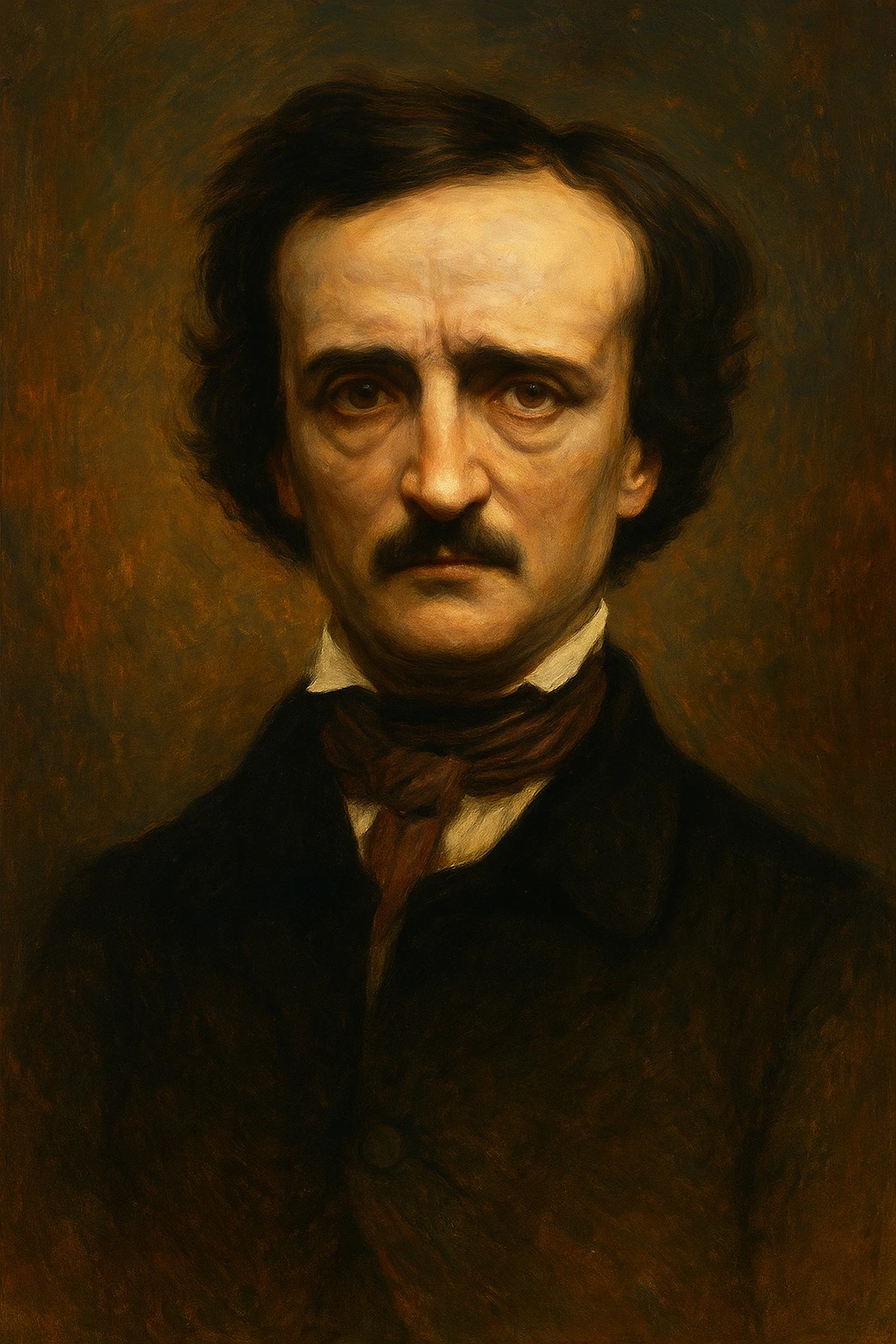

The U.S. Treasury used to print a S100,000 bill. This Bill displays a portrait of Woodrow Wilson and has the denomination boldly engraved in the corners, as all US Bills do. None of this exclusive currency, however, is in circulation. It is used only in transactions between the Federal Reserve System and the Treasury Department. This denomination will never pass over the tellers desks in a local bank branch.First Coins

Lydian Innovation

The first official coins were minted in Lydia (modern Turkey) around 600 BC from electrum, a natural gold-silver alloy.

Government Stamps

These coins bore state symbols, guaranteeing authenticity and standardizing trade.

Influence Spread

Coinage quickly spread across Greece and beyond, shifting economic systems away from barter.Paper Money

Chinese Beginnings

The Tang Dynasty issued early forms of paper money in the 7th century, with official bills emerging during the Song Dynasty.

Global Spread

Marco Polo described Chinese paper currency in Europe in the 13th century, leading to its eventual adoption across the West.

Fiat Shift

Most paper money today is fiat-not backed by gold or silver, but by government trust and regulation.Banking Rise

Medieval Banks

Modern banking traces its roots to Italy, where merchants began offering loans, deposits, and currency exchange in the 12th century.

Central Institutions

Central banks, like the Bank of England (1694), were founded to manage national currencies and debts.

Digital Evolution

Online banking, mobile apps, and digital wallets have transformed how we save and spend money today.Stock Markets

First Shares

The Dutch East India Company issued the world's first publicly traded shares in 1602, launching the Amsterdam Stock Exchange.

Global Trading

Stock markets now influence global economies, enabling investment in business growth and national industries.

High-Speed World

Algorithmic trading, ETFs, and 24/7 markets have reshaped investment landscapes.Cryptocurrency

Bitcoin's Birth

Launched in 2009, Bitcoin introduced decentralized digital money built on blockchain technology.

Beyond Bitcoin

Thousands of cryptocurrencies exist today, with Ethereum, Solana, and others offering smart contract platforms.

Controversy and Innovation

Crypto faces scrutiny over volatility and regulation, but continues to push boundaries in finance and tech.Hyperinflation

Zimbabwe Crisis

In the late 2000s, Zimbabwe experienced monthly inflation rates in the millions, rendering its currency worthless.

German Example

Post-WWI Germany saw citizens wheelbarrowing cash to buy bread, a classic case of hyperinflation.

Stability Importance

These examples highlight the need for sound monetary policy and trusted banking systems.Wealth Inequality

Top Heavy

A small percentage of the global population owns the majority of wealth, a trend growing since the 1980s.

Global Disparities

Developed nations have more per-capita wealth than poorer countries, leading to systemic imbalances.

Solutions Debated

Policy proposals range from taxation reform to universal basic income to close the gap.